26+ trust accounting worksheet

Used most often as a short phrase for anyone performing the duties outlined in a trust document for individuals. Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert.

Ideal Format Of A Cover Letter Formal Business Letter Format Business Letter Format Formal Business Letter

Tax Accounting.

. Sorted alphabetically by description. This is the question and the answer depends on the legislation of the trusts jurisdiction and trusts intentions if voluntary application is selected not on IFRS. Note 1 Summary of Significant Accounting Policies.

Questions and Answers. A loan which has partial amortization and a final larger payment is called a BALLOON loan. The OMB has three circulars or rule books for the accounting administration and auditing of grants.

With workflows optimized by technology and guided by deep domain expertise we help organizations grow manage and protect their businesses and their clients businesses. Other commenters 26 however agreed with the Commissions approach of using the concept of financial reporting oversight role. Refer to the Secondary Field note below for information on entering monetary amounts associated with an accounting docket code.

Guide to Implementation of GASB Statements 25 26 and 27 on Pension Reporting and Disclosure by State and Local Government Plans and Employers. Check your bylaws or other rules of operation for consistency with the annual accounting period entered on line 3. A trust becomes irrevocable when the possibility that the power may be exercised has ended.

Structure of an Accounting Worksheet. A Restatement of Trust is different from a Trust AmendmentThe Restatement of Trust form is designed to restate the entire trust document with all desired changes included. Since 1986 it has nearly tripled the SP 500 with an average gain of 26 per year.

A trust in which persons have fixed entitlements as defined in section 272-5 of Schedule 2F to the ITAA 1936 to all income and capital of the trust at all times during the. A BASE LINE runs East to West and crosses a Principal Meridian at a definite point. Second mortgage types Lump sum.

There are definitions to memorize tax codes to. For further explanation refer to our page on how to change trust beneficiaryIf you wish to make a short Trust Amendment by only changing a few provisions rather than restating the entire trust. An accounting journal is an accounting worksheet that allows you to track each of the steps of the accounting process side by side.

Before December 26 2006 the taxpayer filed a completed Form 3115 with the national office to make that change in method of accounting. Worksheet 2 caters for those items that reconcile T Total profit or loss item 6 with T Taxable income or loss item 7 other than those items specifically included in item 7It does not contain an exhaustive list of reconciliation items. These returns cover a period from 1986-2011 and were examined and attested by Baker Tilly an independent.

Momentum is conserved in either type of collision and is the only value needed for our calculation. Unlike Intuits Mint QuickBooks Online can reconcile your bank statements. IRS Form 1023-EZ Eligibility Worksheet Richard Keyt 2020-03-07T090408-0700 An organization that seeks to be a tax-exempt charity under Section 501c3 of the Internal Revenue Code must apply for tax exempt status by preparing and filing with.

Figuring the tax on qualified dividends can throw even the most seasoned tax accountants for a loop. It does not matter whether the collision is elastic or inelastic although it would be best to assume that its inelastic. 2002-9 for the requested year of change as defined in section 502 of Rev.

If you are a holder of a Power of Attorney you are considered to be an ATTORNEY-IN-FACT. A trust which has the meaning given by section 1209L External Link of the Social Security Act 1991. Monitors the universal administrative procedures drafted by 26 federal agencies on the use of grant money.

Questions and Answers GQA2527 Guide to Implementation of GASB Statement 31 on Accounting and Financial Reporting for Certain Investments and for External Investment Pools. Accounting docket entries for a case can be viewed using the SCOMIS Display Accounting command case number required. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination.

Lets first look at the role of the assignee. And the taxpayer makes that change in method of accounting in compliance with all the applicable provisions of Rev. Budget.

Enabling tax and accounting professionals and businesses of all sizes drive productivity navigate change and deliver better outcomes. The criteria used to determine whether a decedent or grantor is. Second mortgages come in two main forms home equity loans and home equity lines of credit.

Or trust funds belong to your client but are collected from a third party on your client. The assignee is the party that receives the rights and obligations under the contract but wasnt an original party to. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially.

These duties are based around trust accounting and trust administration. Trust accounting trust administration and investment management. SWIFT Update September 26 2019 SWIFT Update September 27 2018 SWIFT Update September 28 2017 SWIFT Update September 5 2019 SWIFT Update September 6 2018 SWIFT Update September 9 2021 System Access.

From part-time side hustle to a full-time business to managing real estate QuickBooks cant be beaten. The financial statements of the citycountydistrict have been prepared in conformity with Generally Accepted Accounting Principles GAAP as applied to governmental unitsThe Governmental Accounting Standards Board GASB is the accepted standard setting. This accounting journal template includes each step with sections for their debits and credits and pre-built formulas to calculate the total balances for each column.

Your first tax year could be less than 12 months. A trustee could be a friend or family member advisor friendly trust company bank. An irrevocable inter vivos trust consisting of property of a grantor who is a resident of this state when the property was transferred to the trust remains irrevocable and a resident trust.

Some commenters 25 stated that the final rule only should apply to the four named positions in the Act eg chief executive officer controller chief financial officer chief accounting officer. All references to accounts below are taken to mean the companys profit and loss account. 46 Notes to Financial Statements.

She has been in the accounting audit and tax profession for more than 13 years working with individuals and. For individuals who need full accounting software or who like to treat their personal finance as a business QuickBooks Online is the answer. If the answer is yes then in most cases the trust is not exempted from consolidation but it also depends on the specific structure of the trust.

For example if your annual accounting period ends in December enter 12 Your annual accounting period is the 12-month period on which your annual financial records are based.

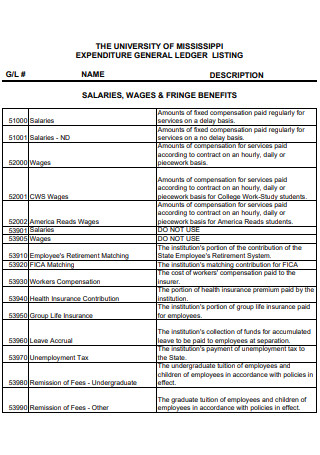

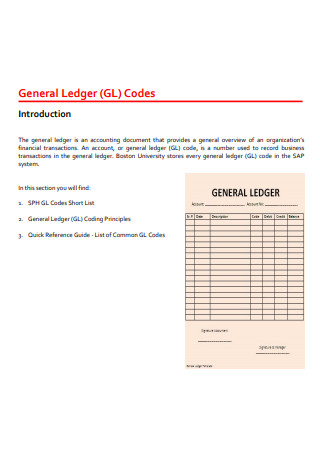

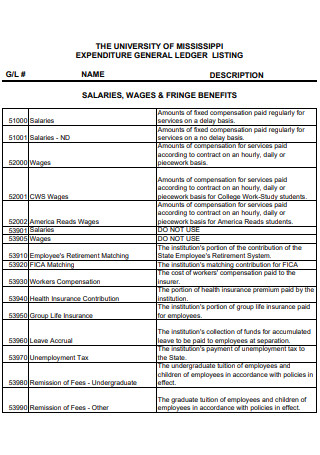

26 Sample General Ledger In Pdf Ms Word

26 Sample General Ledger In Pdf Ms Word

26 Actionable Financial Planner Marketing Ideas Thebrandboy Financial Planning Personal Financial Planning Financial Planner

Pin On Business